What DBS Bank Got Right About Conversational AI That Most Banks Missed

Most banks didn’t lose customers because of bad products.

They lost them because of bad conversations.

Long wait times. Fragmented support. Robotic responses.

In a region where digital expectations are shaped by real-time apps and instant answers, traditional banking interfaces simply stopped working.

That’s where Conversational AI changed the equation and why DBS Bank became one of Asia’s most cited examples of how Conversational AI, chatbot strategy, and a seamless conversational experience can redefine digital banking at scale.

The Real Problem: Banking Conversations Were Broken

Before Conversational AI, banking processes were rigid. Customers were forced to adjust to banking systems, while banking systems were not customer-friendly. Even when banking mobile applications were designed with a great interface, they failed when customers needed answers to their questions quickly.

DBS realized that it wasn’t about adding new functions to improve customer experience. It was about rebuilding conversations from scratch using Conversational AI and AI-powered chatbots. This shift from interfaces to conversations became the foundation of DBS’s transformation.

Why Conversational AI Was the Strategic Unlock

Unlike scripted automation, Conversational AI understands intent, context, and nuance. That distinction matters in banking, where questions are rarely straightforward.

By deploying a chatbot powered by Conversational AI, DBS enabled customers to:

- Ask questions naturally

- Receive contextual responses

- Complete tasks without friction

The result wasn’t just faster resolution. It was a stronger conversational experience that felt human, reliable, and consistent across channels. This is where Conversational AI stops being a tool and becomes an interface.

Designing a Conversational Experience That Customers Trust

A successful chatbot doesn’t just answer questions. It builds confidence.

DBS focused heavily on conversational design, how the conversational experience flows, how responses adapt, and when human escalation is triggered. They wanted AI chatbots to handle simple inquiries and for difficult inquiries to go smoothly to humans.

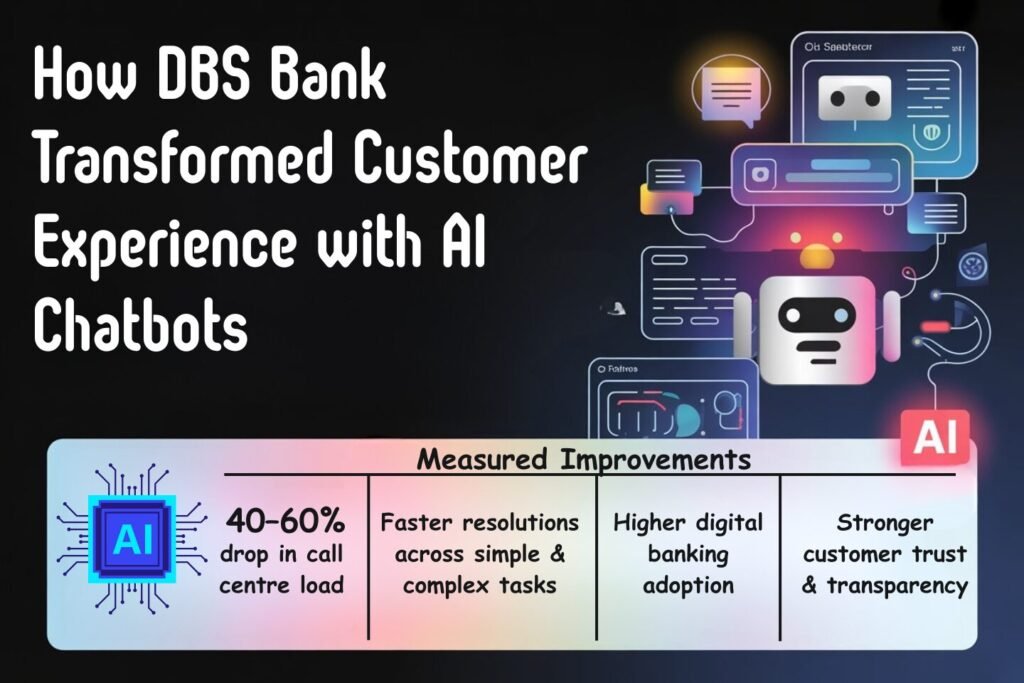

That balance is critical. Conversational AI supports human teams; it doesn’t replace them. In fact, DBS saw measurable improvements in customer experience by letting employees focus on high-value interactions.

What This Means for Digital Banking Across Asia

The digital economy in Asia is very dynamic. Consumers want and expect instant responses and seamless support. Digital banking platforms that rely only on static apps or IVRs fall behind quickly.

DBS proves that Conversational AI delivers a competitive advantage when paired with a thoughtful conversational experience strategy. This is why conversations, not screens, are becoming the primary interface in modern digital banking.

Such learnings have become core topics at the CACES Asia, where executives examine ways in which chatbot platforms, AI chatbots, and conversational platforms are revolutionizing customer interactions.

Governance, Trust and Safety

DBS has implemented multi-layered governance mechanisms within these Conversational AI systems which include: Audit logs, backup to human agents, Data Protection controls, and Defined Escalation rules. The combination of automation and governance provides not only the safety of the customer but also establishes the foundation of Trust in the experience that Customers have when they are interacting with DBS within the Financial Services industry.

Looking ahead

DBS’s success isn’t just about finance. It’s about how organizations design conversations at scale.

Whether in banking, telecom, retail, or travel, the same rule applies:

If your conversational experience feels slow or scripted, users disengage.

If your Conversational AI feels intuitive and responsive, loyalty follows.

That’s the future enterprises are discussing at the CACES Asia, and the standard customers now expect.

Conclusion

DBS didn’t win by launching another banking app.

It won because it solved the problem related to conversation.

By investing in Conversational AI, deploying a purpose-built chatbot, and prioritizing a consistent conversational experience, DBS redefined what modern digital banking looks like in Asia.

For organizations serious about customer experience, the lesson is clear:

The next competitive edge isn’t a feature, it’s a conversation.

FAQ's

DBS Digibot is DBS' virtual conversational assistant. It is available on digibank applications and web channels and provides answers to questions, starts simple transactions, and helps customers through various processes.

DBS uses Conversational AI to automate repetitive tasks, reduce wait times, and deliver unique, personal responses to questions in a timely manner — which results in higher customer satisfaction and less time waiting for an answer.

Gen AI chatbot at DBS provides LLM-based solutions to deliver customers with the most accurate information from a variety of reputable sources. It drafts responses and escalates queries to an employee when required.

Yes, DBS offers the Digibot platform for Consumer Banking customers and has also introduced Gen AI chatbots to support Corporate Bank and Internal Customer Service teams.

Conversational AIs can help contact center employees by giving them access to an AI co-pilot to listen in on a customer's call, provide suggested responses when needed, and greatly limit the need for time-consuming searching. Thus, conversational AIs' utilization can lead to quicker resolutions and higher levels of service quality due to the staff's efficiency.

As part of their implementation of the conversational AI, DBS implemented a security and compliance infrastructure via data protection, audit trails, and escalation processes that allow for compliance with regulatory and privacy regulations.

The businesses saw reduction in the Average Handle Time (AHT) and volume of contacts due to automation, an increase in the use of Digital, and an increase in customer satisfaction (CSAT) scores following the adoption phase.

DBS has invested in building and enhancing its conversational AIs and Generative AI's chatbot capabilities with new languages and retrieval strategies that allow servicing of Singapore's diverse multilingual customer base.

DBS regularly attends and participates in industry conferences and Conversational AI sessions, sharing their results, experiences, and learnings with other banks and the broader community, as well as providing their playbooks for other banks to learn from.